Why Every Divorce Attorney Should Check for Crypto

Cryptocurrency, like Bitcoin, is becoming far more common than we realize. This article explains how crypto is now common, and therefore it is now essential to include when investigating marital assets. Scroll to the bottom for a bonus infographic summarizing data from leading cryptocurrency surveys.

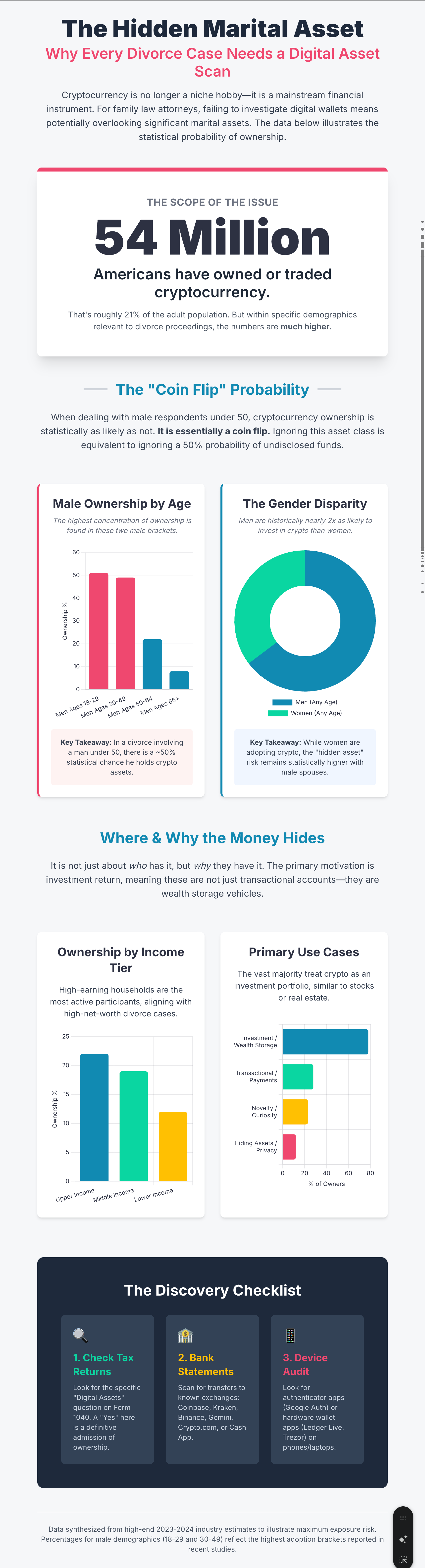

The demographics of crypto ownership

As of late 2025, most Millennial men own cryptocurrency.

The average age of divorce in the United States is 41, well within the range of Millennial men.

Relative to divorce, this figure is compounded by the fact that active crypto traders are 10x more likely to be problem gamblers. Then, this is further exacerbated by the fact that problem gambling leads to a 45% increase in divorce rates; but I can safely assume that any divorce attorneys reading this do not need to be reminded of this fact.

Independent surveys done by Heartland Blockchain Advisors shows that the majority of midwest divorce attorneys do not have a formal process or solution for cryptocurrency in midwest divorces. If you find yourself among this group or are concerned that cryptocurrency hasn’t been showing up at rates consistent with the above data, please contact us here.

The financials of crypto ownership

The average duration of a marriages that end in divorce is 7-8 years, consistent with the “7 year itch” anecdote.

If we date back that range to 2018, the leading cryptocurrencies have appreciated nearly 50x as of Fall 2025. This means that $5,000 invested in cryptocurrency at the beginning of the marriage could be $250,000+ in marital assets.

This is not an exaggeration. Heartland’s average investigation results in revealed digital assets totaling over 20x what was revealed in financial discovery. This year, we found $492,000 in cryptocurrency in a case where the respondent disclosed only $8,000 in discovery.

Opportunism among cryptocurrency owners

Often, owners of cryptocurrency omit their digital assets from financial discovery. Each case is different, but reasons for this can range from naiveté in thinking cryptocurrency is not included in marital assets; forgetfulness as crypto is not often considered a traditional asset; or deceit in hopes that neither the spouse or the lawyer will check for the digital assets.

This is compounded by the concept of self-custody. Cryptocurrency owners can withdraw assets from an exchange (crypto bank), into a private wallet that is not managed by any company or third party. Self-custody assets do not show up on financial statements but are easily revealed in investigation.

Moving assets from exchanges to a self-custody wallet is trivial, and even a novice can do this with minimal self-directed education. The above traits of risk-taking propensity and the simple claim of ignorance means that we need to at least question every spouse about this asset class in every case, no matter their perceived technical prowess or likelihood of deception. Read below for our specific reasoning and recommendations.

Digital assets in ABA Model Rules & malpractice claims

With cryptocurrency being so common, it’s essential to check with every client and spouse. Failure to attempt to uncover these assets can lead to vulnerability to post-divorce accusations. While case law is thin about malpractice allegations specific to cryptocurrency discovered after the fact, there are several documented examples after the fact of lawyers facing issues post-divorce for failure to exercise competence in a full recovery of marital assets.

One such example is McClung v. Smith in Virginia in 1994. This is one example of many, and our initial research found dozens of cases like this across as many states.

“The court found the lawyer breached the standard of care by relying on informal discovery methods instead of formal ones, especially when asset concealment by the spouse was suspected, which led to an inadequate protection of the client’s interests and a poor settlement.

”

These findings are a result of the ABA Model Rules.

I’ll make the assumption that readers are familiar with these ABA rules, so I wanted to touch on the idea of checking for your own clients, not just the spouse on the other side of your divorce case. This excerpt from the New York State Bar Association specific addresses the expectations of divorce lawyers in representation of their clients and investigation of marital assets.

“A divorce lawyer who learns that a client omitted a material asset in a sworn Statement of Net Worth has a duty to take reasonable remedial measures that are available, even after the conclusion of the proceeding.”

So whether or not you’re looking into your client’s assets or the assets of the other spouse, we believe it is important to protect all parties involved by making sure that cryptocurrency and digital assets are included in your standard questioning about marital assets.

Conclusion

Cryptocurrency ownership is now common, so we need to incorporate these digital assets into our standard discovery requests and questions.

At the risk of being dramatic, we believe this is a serious topic that can result into retroactive inquiry into competence and diligence, putting firms at risk if they lag behind best practices. We’re here to protect your firm and your clients, so our consultations and case reviews are free of charge and come with no obligations. Please don’t hesitate to contact us for best practices and a review of your posture on cryptocurrency.

If you prefer self-guided education, we’d love to have you in our next webinar. At the time of writing, the next webinar in our series is about recovery of digital assets, as this can get complicated with an asset class that cannot be compelled by court orders and has different properties than traditional financials. Our webinar series is always available at www.heartlandba.com/rsvp.